Wallet share growth

Nowadays, there is virtually no need to ever step foot into a brick-and-mortar bank branch, stock brokerage, or the offices of an insurance agent, or financial/tax advisor. Financial service customers now transfer funds, make payments, apply for loans, invest, and purchase insurance, at the press of a button on a laptop, or smart phone app.

FSPs are in a unique position to take advantage of the digital playing field, by leveraging real-time operational intelligence to increase the amount of money each customer spends with them. Upselling and cross-selling existing clients is not only the fastest way to make a profit, but also much less expensive and time-consuming than acquiring new customers.

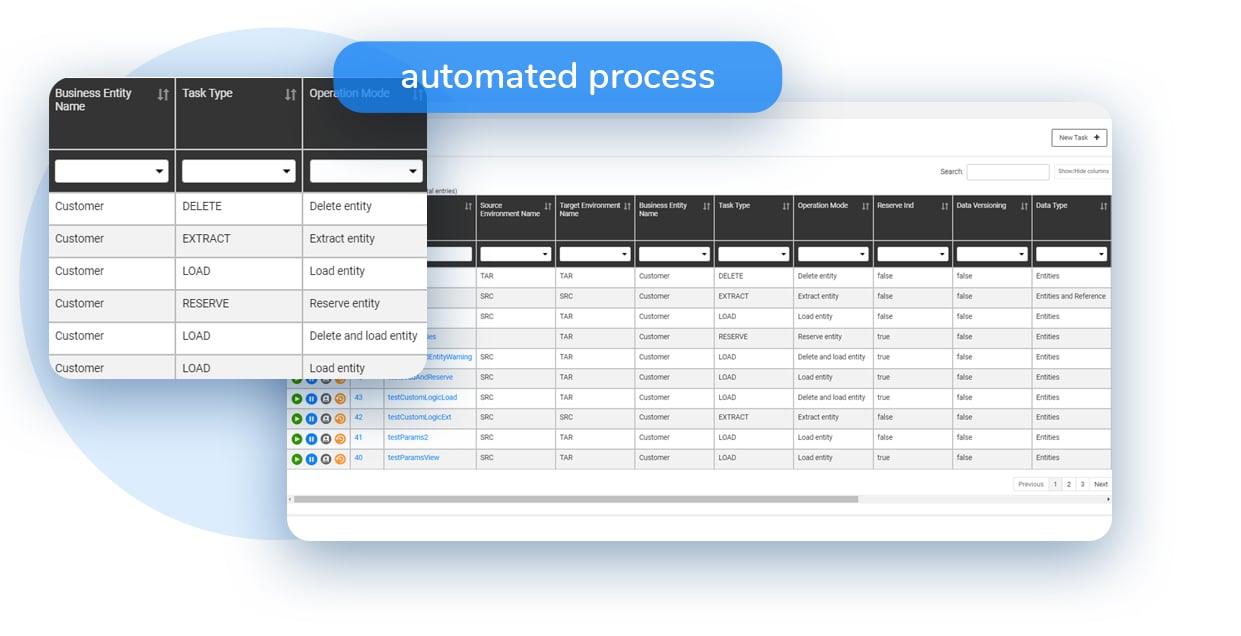

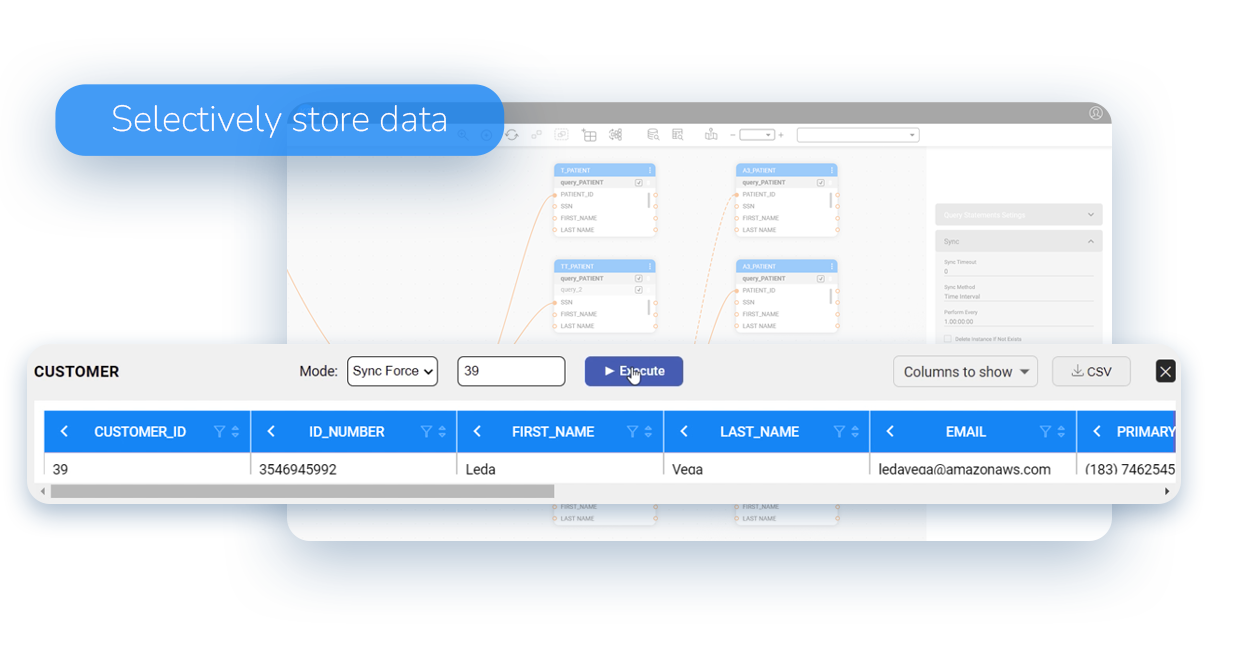

The K2View Data Product Platform, and patented Micro-Database™ technology, deliver real-time and trusted customer data to decisioning engines, machine learning algorithms, and customer analytics. Using K2View's financial data management solution, FSPs ingest, transform, secure, and orchestrate data from disparate data sources to deliver a trusted and complete view of the customer and business data.