Table of contents

Conversational AI in banking revolutionizes customer service with 24/7 support, personalized interactions, and secure transactions via bank savvy chatbots.

AI leapfrogs the digital divide in banking

Conversational AI in banking revolutionizes customer service with 24/7 support, personalized interactions, and secure transactions through intelligent chatbots.

The banking industry stands at a digital crossroads where customer expectations meet regulatory demands, competitive pressure from fintech startups, and the need for operational efficiency. As traditional banks compete with digital-first challengers, conversational AI emerges as a transformative force that can restore the personal touch customers crave while delivering the speed and convenience of modern digital banking.

Recent research indicates that conversational AI could win back 72% of bank customers1, highlighting the technology's potential to reshape customer relationships in financial services. With 88% of banking executives believing conversational AI will soon become the primary channel for customer interactions2, banks are rapidly adopting these intelligent systems to meet evolving customer demands.

What is conversational AI in banking?

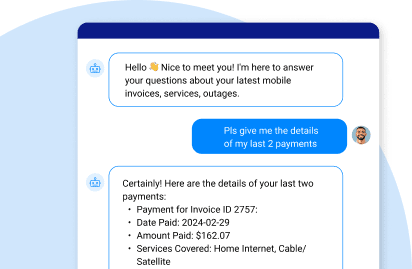

Conversational AI in banking represents a sophisticated blend of Natural Language Processing (NLP), Machine Learning (ML), and conversational AI platforms specifically designed for financial services. Unlike traditional banking chatbots that rely on rigid decision trees, modern conversational AI systems understand context, sentiment, and complex financial queries to deliver human-like interactions across multiple channels.

These intelligent systems function as AI virtual assistants capable of handling everything from basic account inquiries to complex transaction processing. They leverage Retrieval-Augmented Generation (RAG) to access real-time customer data and provide personalized responses grounded in current account information, transaction history, and regulatory compliance requirements.

Key benefits driving conversational AI adoption

1. Enhanced customer service efficiency

Banks implementing conversational AI experience significant improvements in AI customer service delivery. These systems provide 24/7 availability, eliminating wait times and enabling customers to access services outside traditional banking hours. A customer service chatbot in banking can resolve up to 80% of routine inquiries without human intervention, freeing agents to focus on complex financial advisory services.

2. Operational cost reduction

Financial institutions report substantial cost savings through intelligent automation. By deploying conversational AI chatbots for routine tasks like balance inquiries, payment processing, and account management, banks reduce operational overhead while maintaining service quality. The technology handles high-volume, repetitive interactions at scale, significantly lowering per-interaction costs.

3. Personalized financial experiences

Modern conversational AI systems excel at personalization by analyzing customer data in real-time. These platforms can recommend financial products based on spending patterns, provide customized investment advice, and offer proactive alerts about account activity. This level of personalization helps banks strengthen customer relationships and increase cross-selling opportunities.

Core use cases for conversational AI in banking

The following table shows 5 core use cases for conversational AI in banking, indicating the respective benefits and operational impact:

|

Use case |

Benefits |

Operational impact |

|

Account management |

24/7 balance inquiries, transaction histories, and statement requests |

Fewer routine calls |

|

Payment processing |

Fund transfers, bill payments, and peer-to-peer transactions |

Faster transaction completion |

|

Fraud detection |

Real-time alerts, transaction verification, and account security |

Improved fraud response time |

|

Loan applications |

Pre-qualification, document collection, and status updates |

Reduced app processing time |

|

Investment advisory |

Portfolio updates, market alerts, and personalized recommendations |

Increased engagement rates |

Let’s deep-dive into 3 fundamentals contained in the above use cases:

-

Identity verification and compliance

Banks leverage conversational AI for secure identity verification processes that comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. These systems guide customers through multi-factor authentication while maintaining detailed audit trails for regulatory compliance. The technology can process identity documents, verify customer information against multiple databases, and escalate suspicious activities to human agents seamlessly.

-

Proactive customer support

Advanced conversational AI for customer service systems monitor account activity and proactively reach out to customers when attention is needed. This includes payment reminders, fraud alerts, account maintenance notifications, and personalized financial insights. Such proactive engagement helps prevent issues before they impact the customer experience.

-

Multilingual and multichannel support

Global banks utilize conversational AI to provide consistent service across different languages and channels. Whether customers interact via mobile banking apps, websites, social media platforms, or voice assistants, the AI maintains context and provides unified experiences. This omnichannel approach ensures customers receive consistent service regardless of their preferred communication method.

Addressing conversational AI banking challenges

Here are 3 key challenges associated with conversational AI in banking and tips on how to address them:

-

Data security and privacy

Banking conversational AI must adhere to stringent security standards including PCI DSS, GDPR, and regional banking regulations. Solutions implement end-to-end encryption, secure data transmission, and strict access controls to protect sensitive financial information. Regular security audits and compliance monitoring ensure ongoing protection of customer data.

-

Integration complexity

Modern banks operate complex technology ecosystems with legacy systems, core banking platforms, and third-party services. Successful conversational AI implementations require sophisticated integration capabilities that can access multiple data sources while maintaining real-time performance. APIs and middleware solutions facilitate seamless connectivity across diverse banking systems.

-

Regulatory compliance

Financial services face extensive regulatory requirements that conversational AI systems must navigate carefully. These include consent management, audit trail maintenance, fair lending practices, and consumer protection regulations. Advanced AI platforms incorporate compliance engines that automatically enforce regulatory requirements and generate necessary documentation

How conversational AI enhances personal banking

The implementation of conversational AI in banking can be facilitated via the following advanced capabilities:

-

Agent assistance and human handoff

Agent assist capabilities transform how human representatives interact with customers. When conversational AI systems escalate complex issues to human agents, they provide comprehensive context including conversation history, customer profile information, and recommended solutions. This seamless handoff ensures customers don't repeat information and agents can immediately focus on problem resolution.

-

Sentiment analysis and emotional intelligence

Banking AI systems increasingly incorporate sentiment analysis to detect customer frustration, satisfaction, or confusion during interactions. This emotional intelligence enables appropriate response adjustments, proactive escalation to human agents when needed, and personalized communication styles that match customer preferences.

-

Predictive analytics and recommendations

By analyzing customer behavior patterns, conversational AI can predict financial needs and proactively offer relevant services. This includes identifying customers who might benefit from consolidation loans, investment opportunities based on life events, or budgeting assistance during spending pattern changes.

Industry success stories and best practices

Leading financial institutions demonstrate the transformative potential of conversational AI through successful implementations. Banks report 15% reductions in average handling times, improved customer satisfaction scores, and significant increases in digital channel adoption.3

Such success stories highlight the importance of starting with conversational AI chatbot vs assistants evaluations to determine the right approach for specific use cases.

Best practices include:

-

Starting with high-volume, low-complexity use cases

-

Ensuring seamless integration with existing banking systems

-

Implementing robust security and compliance frameworks

-

Providing clear escalation paths to human agents

-

Continuously training AI models with real customer interactions

-

Maintaining transparency about AI capabilities and limitations

The future of intelligent banking

As conversational AI technology continues advancing, banks are exploring conversational AI vs generative AI applications to further enhance customer experiences. Future developments include more sophisticated natural language understanding, improved emotional intelligence, and enhanced integration with emerging technologies like blockchain and IoT devices.

The convergence of conversational AI with other banking technologies creates opportunities for super smart financial services that anticipate customer needs, provide proactive support, and deliver personalized experiences at scale. This evolution positions conversational AI as a strategic differentiator in an increasingly competitive banking landscape.

Powering conversational AI with unified data

Successful conversational AI in banking depends on access to comprehensive, real-time customer data across all banking systems. Fragmented data sources, legacy system limitations, and data quality issues can significantly impact AI performance and customer satisfaction.

K2view addresses these challenges through a unique AI chatbot for customer service, which grounds your GenAI chatbot with enterprise data. By integrating data from core banking systems, transaction histories, customer interactions, and external sources, K2view ensures that banking conversational AI delivers accurate, personalized responses while maintaining strict security and regulatory compliance.

This unified data approach enables banks to implement conversational AI that truly understands each customer's complete financial picture, leading to more effective interactions, better problem resolution, and stronger customer relationships.

Discover how the K2view AI chatbot for customer service

delivers a superior banking experience via conversational AI.