Financial analysts walk a legal tightrope when researching and testing real data. That’s where synthetic financial data comes in. Read on to learn more.

What is Synthetic Financial Data?

Synthetic financial data is data that is not derived from actual market transactions. Created via generative AI, rule-based or other synthetic data generation techniques, synthetic financial data is designed to accurately replicate characteristics found in real market information – such as trading volumes, price movements, volatility, and other metrics.

Synthetic financial data is frequently used for research, testing, and development of economic models, trading algorithms, and risk management strategies. Both analysts and researchers leverage synthetic data to investigate possible market scenarios, assess how strong or weak their strategies are in a controlled environment, and check the impact of different variables on new or existing financial instruments.

Synthetic financial data can be extremely valuable for stress testing, predictive modeling algorithm validation, and many other financial applications. Yet there are limitations to its usefulness because it may not be able to fully reflect the intricacies and nuances of actual market behavior.

Thus, financial organizations are advised to exercise caution in relying solely on synthetic financial data for decision-making. To lower risk, it's crucial to use high-quality synthetic financial data alongside real-world data to derive more accurate insights and make more informed financial decisions.

Why Do Organizations Need Synthetic Financial Data?

Like synthetic patient data in the healthcare industry, synthetic financial data offers companies a versatile and powerful, yet controlled, means of testing strategies, managing risk, ensuring compliance, conducting research, and providing training. By replicating real-world financial scenarios while safeguarding sensitive information, enterprises use synthetic financial data for numerous mission-critical functions, including:

-

Testing and refining

Synthetic financial data can offer a controlled environment for traders or analysts to test and refine trading algorithms, investment strategies, or financial models. Actual market data is often expensive, limited, and subject to privacy regulations. This makes synthetic test data and test data masking good options for enterprises that need to examine diverse scenarios, fine-tune strategies, or stress test systems – without the risk of divulging personal information.

-

Risk management

Synthetic financial data helps companies assess and manage risk more effectively. Using a synthetic dataset to simulate market conditions or economic events, financial service providers are better able to evaluate how portfolios or financial instruments perform under different circumstances. This helps financial services firms identify possible vulnerabilities and evaluate potential losses – while developing proactive mitigation strategies to counter them.

-

Compliance

Synthetic financial data is an invaluable resource for regulatory compliance purposes. Organizations that need to adhere to strict local and international regulations can use synthetic financial to validate the compliance of systems without compromising sensitive or personal information.

-

Research

Economists, financial analysts, and other researchers use synthetic financial data to explore economic theories, market trends, and financial behavioral patterns – helping them generate insights for more informed decision-making.

-

Training

Synthetic financial data can be an outstanding training tool for new employees, traders and analysts. Using synthetic data, trainees can practice before engaging with actual markets and financial data, gaining valuable experience without exposing the organization to risk.

How is Synthetic Financial Data Created?

Synthetic financial data is generated via a series of complex mathematical and statistical processes that aim to replicate the characteristics of actual financial information. These methods involve various generation techniques – for example:

-

Generative AI – via Generative Pre-trained Transformers (GPT), Generative Adversarial Networks (GANs), or Variational Auto-Encoders (VAEs) – learns how to create synthetic data based on the patterns and distribution of real market data.

-

A rules engine assembles synthetic datasets via pre-defined business policies. Financial analysts and researchers can add intelligence to the synthesized data by referencing the relationships between the financial data elements, to ensure the relational integrity of the generated data.

-

Entity cloning aggregates data from every source system associated with a single business entity (e.g., investor) and anonymizes it for privacy compliance. It then replicates the entity, creating separate identifiers for each clone to ensure uniqueness.

-

Data masking replaces sensitive data with artificial, yet structurally consistent, values. Data masking tools ensure that Personally Identifiable Information (PII) can’t be linked to people, while retaining the statistical characteristics and relationships of the data.

Synthetic Financial Data Challenges

Creating synthetic financial data is complex due to the dynamics of financial markets. Synthetic data companies are addressing the following challenges:

-

Accuracy and Realism

It’s hard to ensure that synthesized financial data realistically reflects the complex patterns, distribution and behaviors of real financial markets. Synthetic financial data needs to capture not only statistical patterns and characteristics of multifaceted market behaviors, but also the intricate interplay between them.

-

Validation and calibration

It’s difficult to assess the quality and reliability of synthetic financial data, since it needs to be validated against real data to ensure that it aligns with historical observations. It's also easy calibrating a synthetic dataset to match specific market characteristics.

-

Correlation and dependency

Financial instruments and models often have intricate correlations and complex interdependencies. It is highly challenging to maintain these relationships accurately in synthetic data, since even minor deviations can lead to unrealistic outcomes or misleading insights.

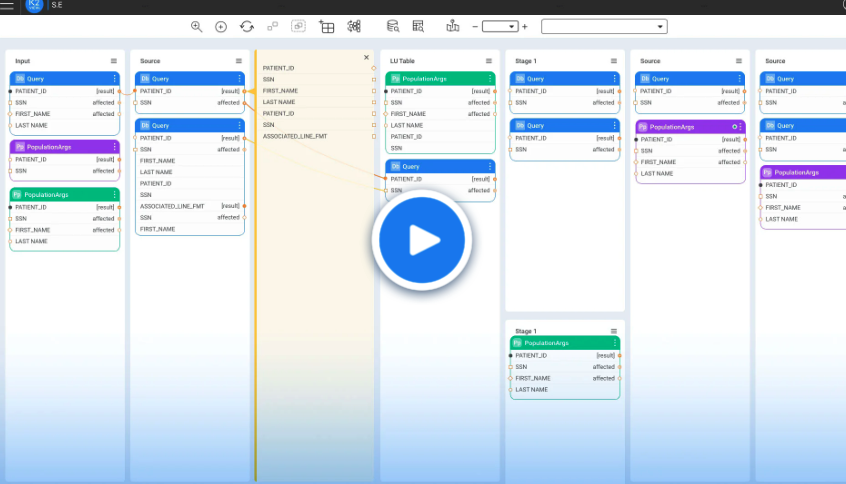

Synthetic Financial Data Based on Business Entities

Economists, financial analysts, and other market professionals are turning to synthetic data generation tools based on business entities, to create highly realistic synthetic data whose referential integrity is enforced in the target systems. These solutions leverage business entities (such as individual analysts, investors, or traders) which are automatically modeled based on source system metadata.

Entity-based synthetic financial data generation leverages a variety of different techniques, alone or in tandem, as listed below:

- Generative AI generates lifelike, synthetic financial data using machine learning algorithms.

- A rules engine creates synthetic financial data based on pre-defined business policies.

- Entity cloning collects business entity (e.g., trader) data, anonymizes it, and then clones it.

- Data masking obscures sensitive data and PII to generate realistic, compliant financial data.

Only K2view synthetic data generation tools

support all these techniques by design.